Rather than write an article and publish it after a week of fiddling and editing, I’m going to publish this one early and update it as it evolves.

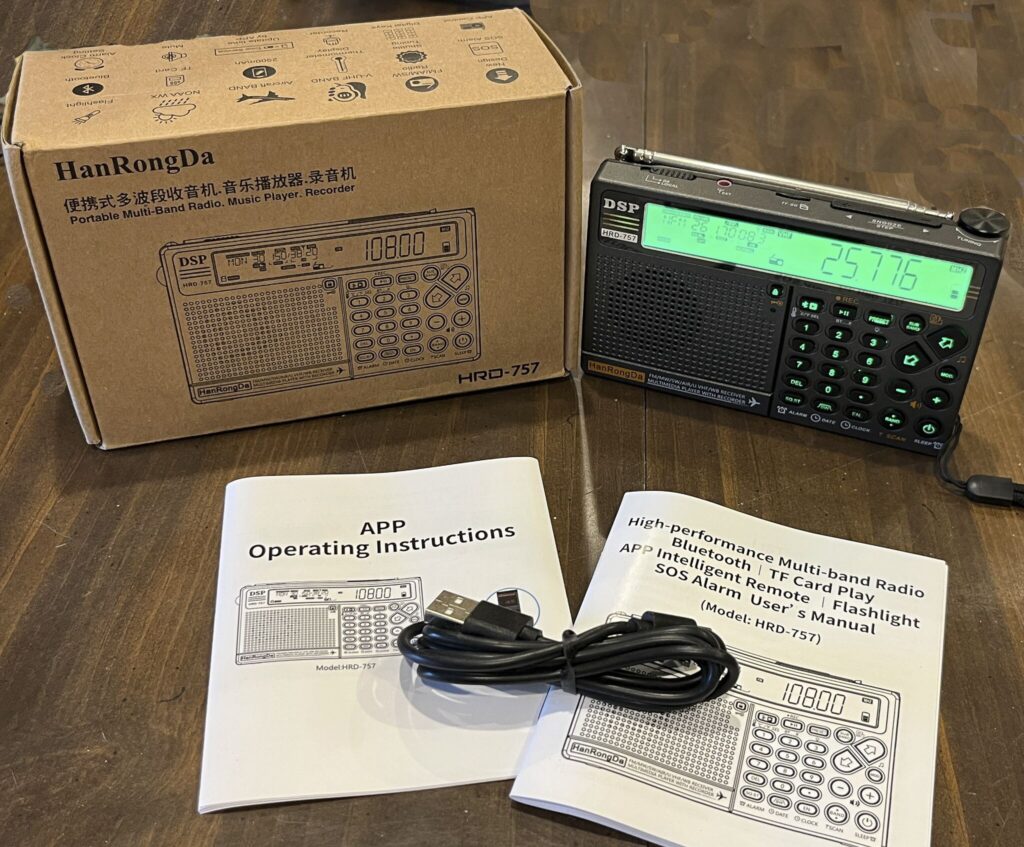

I had a negative first impression of the HanRongDa HRD-757 and I posted some of my objections on the OfficialSWLChannel Facebook group. I got some pushback that I wanted to check out.

Birdies

The first challenge is that the other user didn’t find any birdies.

I didn’t go out looking for birdies, but I got a biggie on the first station in my band scan.

Testing with two other radios on the same frequency had no distortion. I sort of jumped to the conclusion that the radio is riddled with birdies without a really exhaustive test to see how many there are. The 757 reminds me of another HanRongDa radio, the HRD-701, that has similar distortion. Further testing found a couple more, but it is not “riddled” with them.

Continue reading